Q2-2022 : State of Venture Capital Investments in the Next-11 Countries

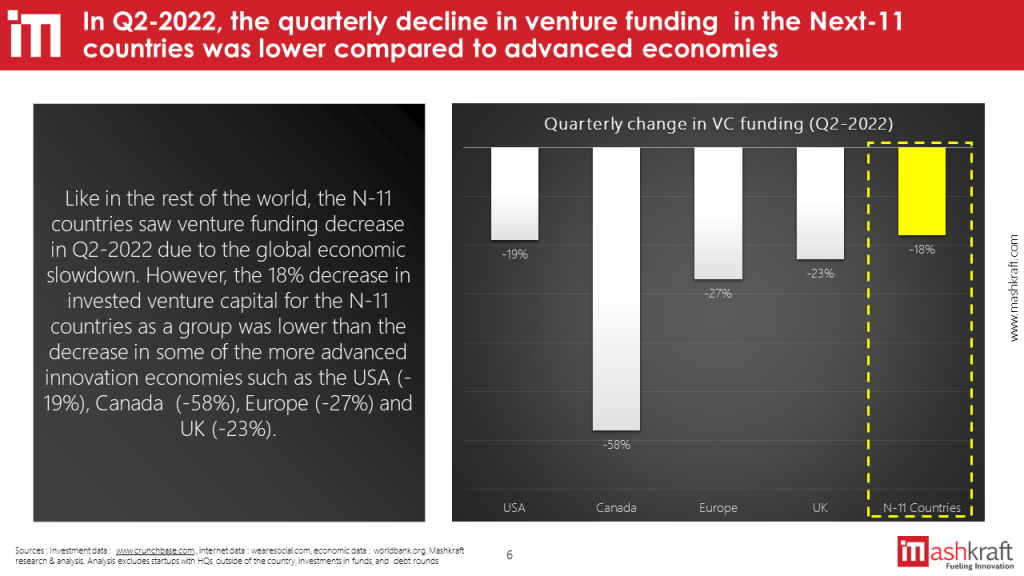

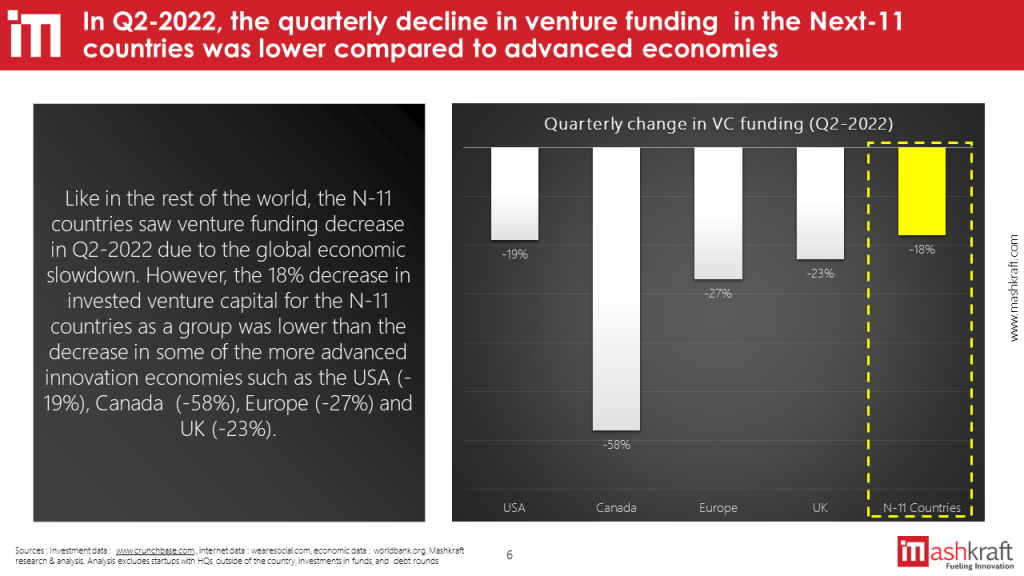

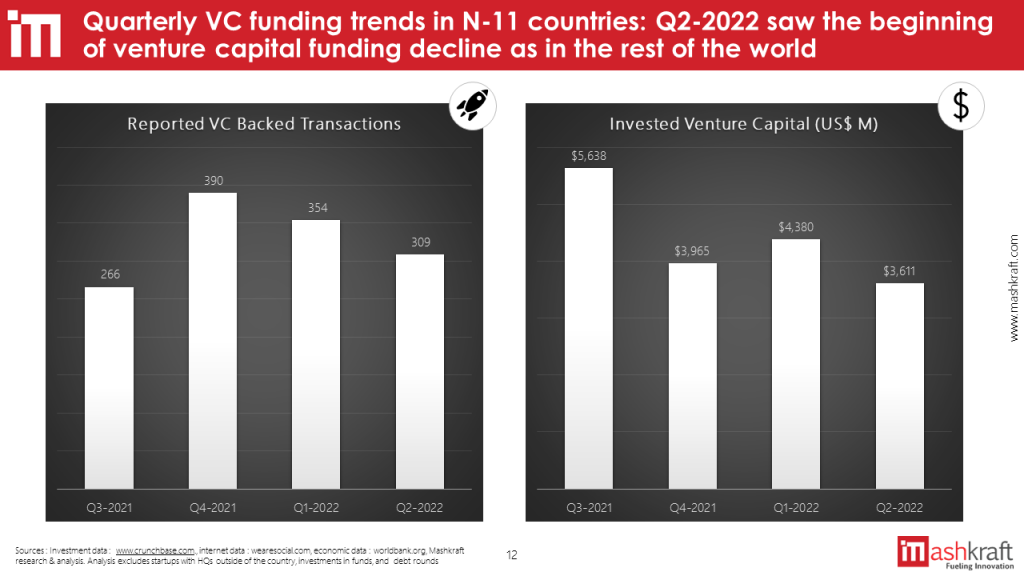

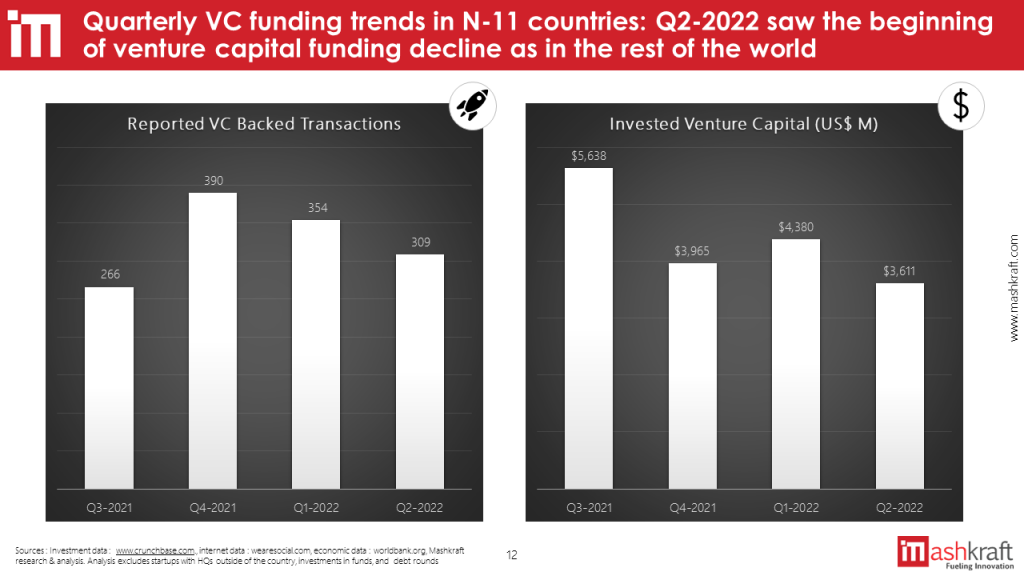

Impact of the global economic downturn

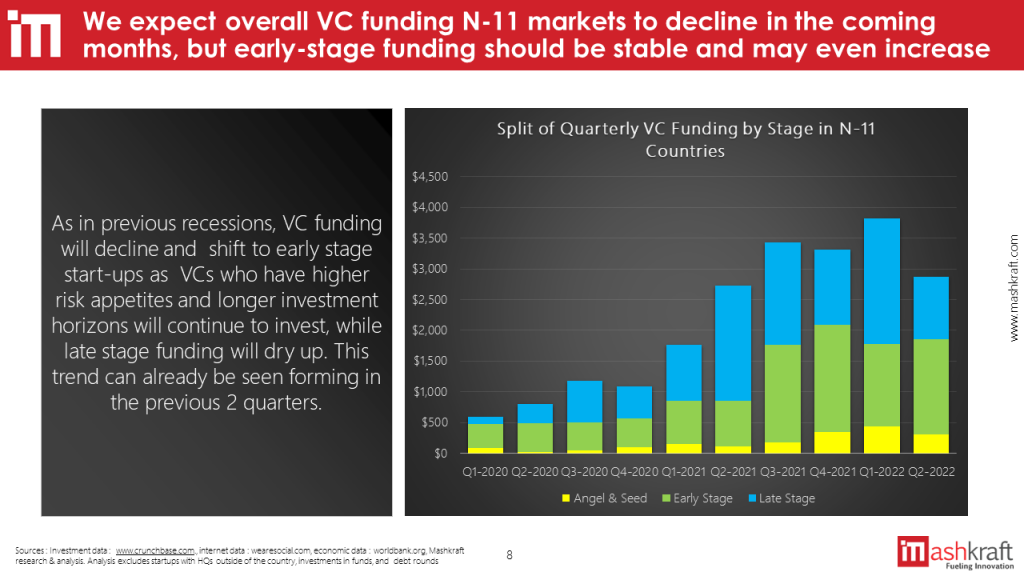

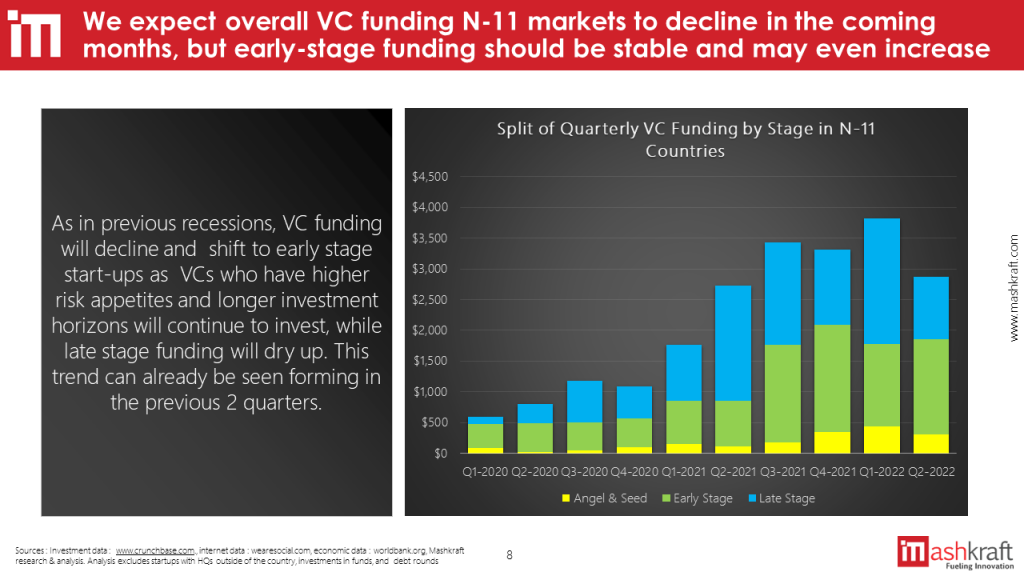

We expect venture capital funding in the N-11 countries to continue to decrease in synch with the expected global decline. We expect late stage startups who were unable to raise funding in 2021, are in hypercompetitive and over-funded sectors and serving inflation sensitive consumer verticals to be most at risk of faiure in the coming months. We also expect early stage funding to stay relatively stable because of the higher risk apetite of investors in this space.

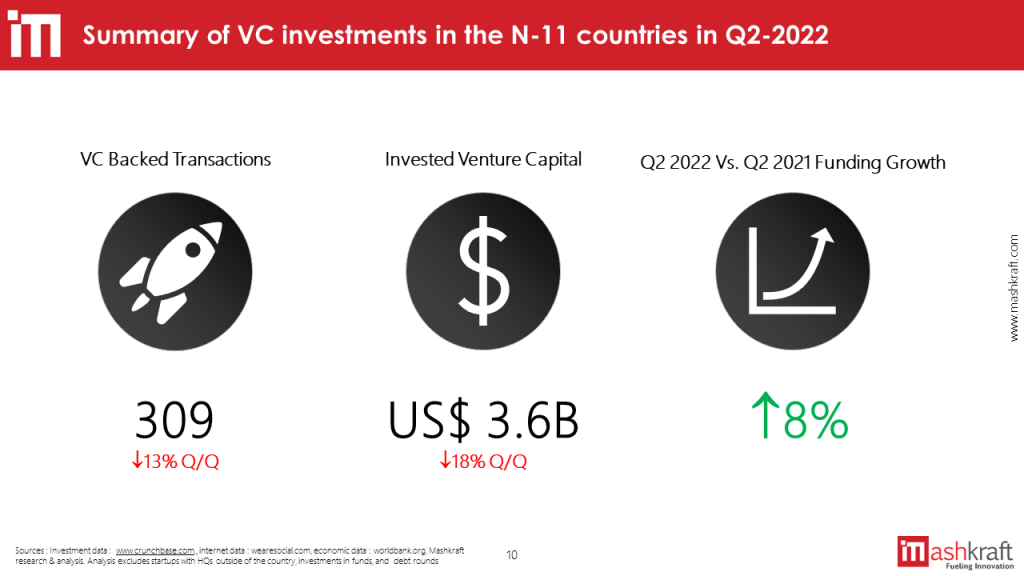

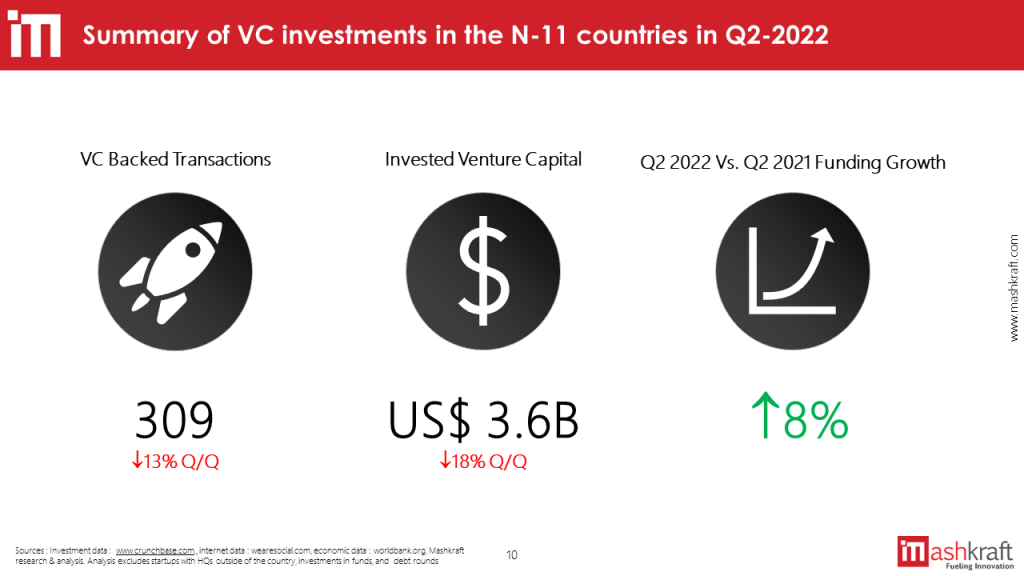

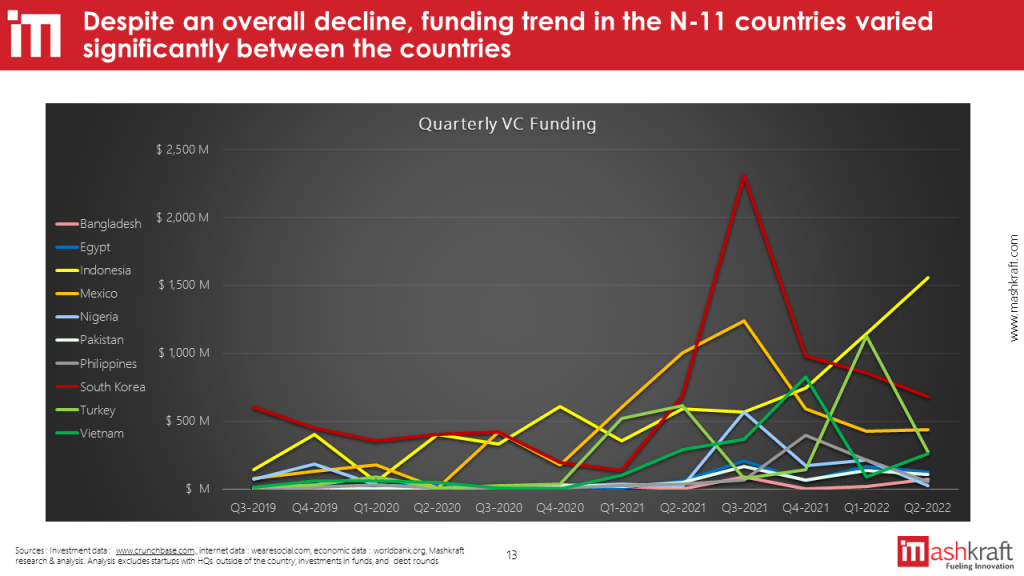

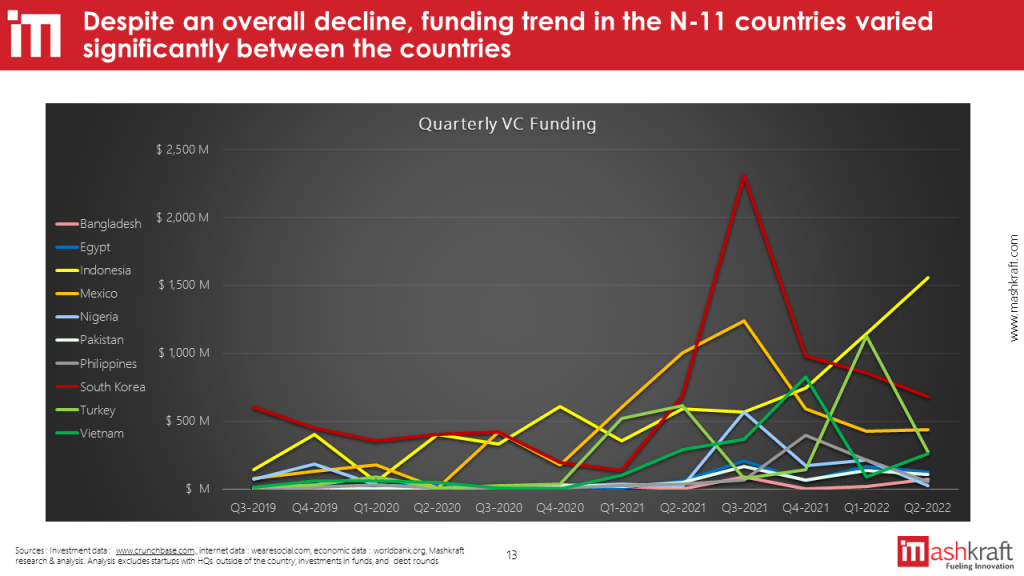

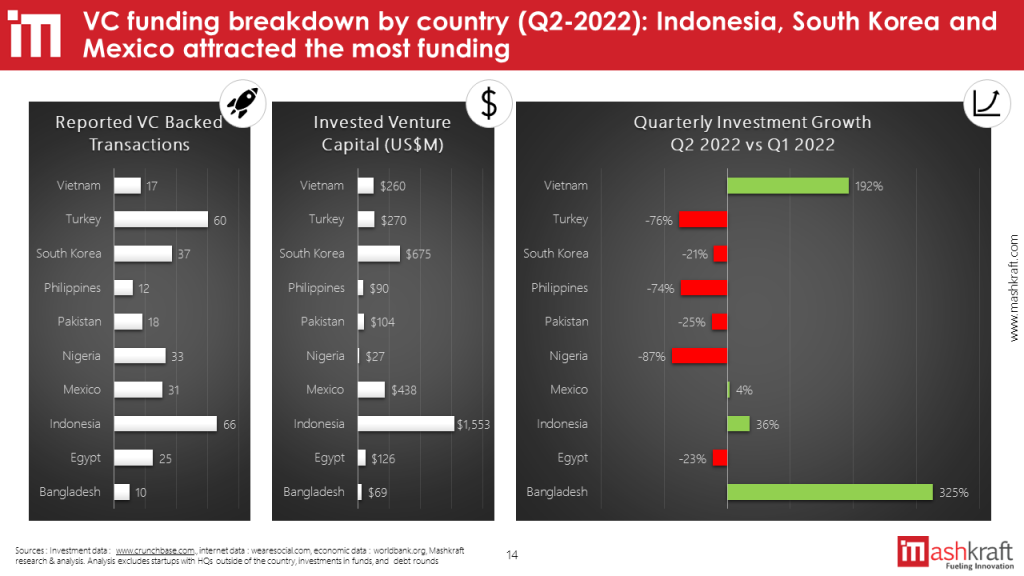

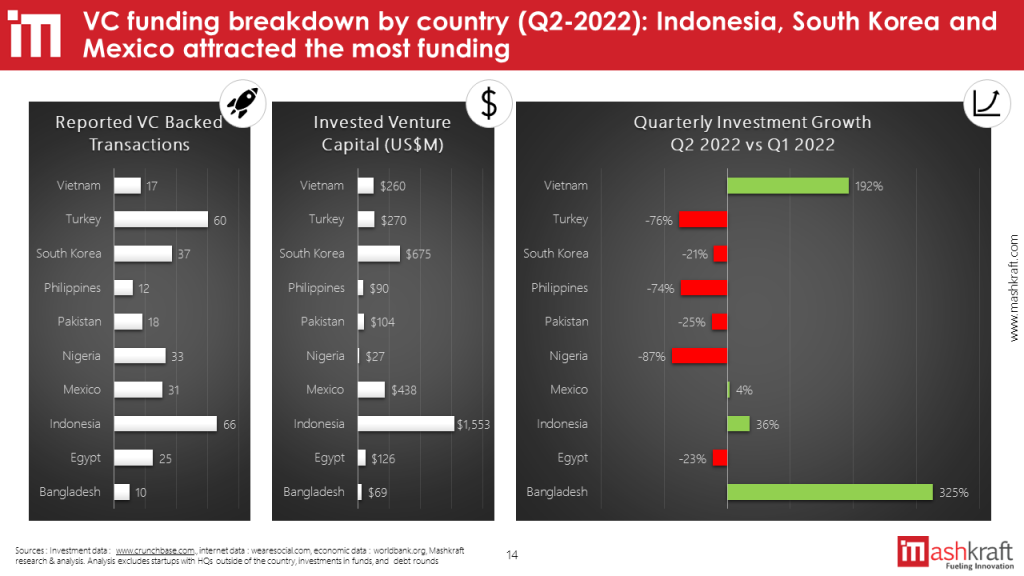

Investment Summary

There was a great variation between the N-11 countries in temrs of capital attracted. Indonesia led the pack , maintaining its momentum in attracting venture capital funding, especially for later stage companies.

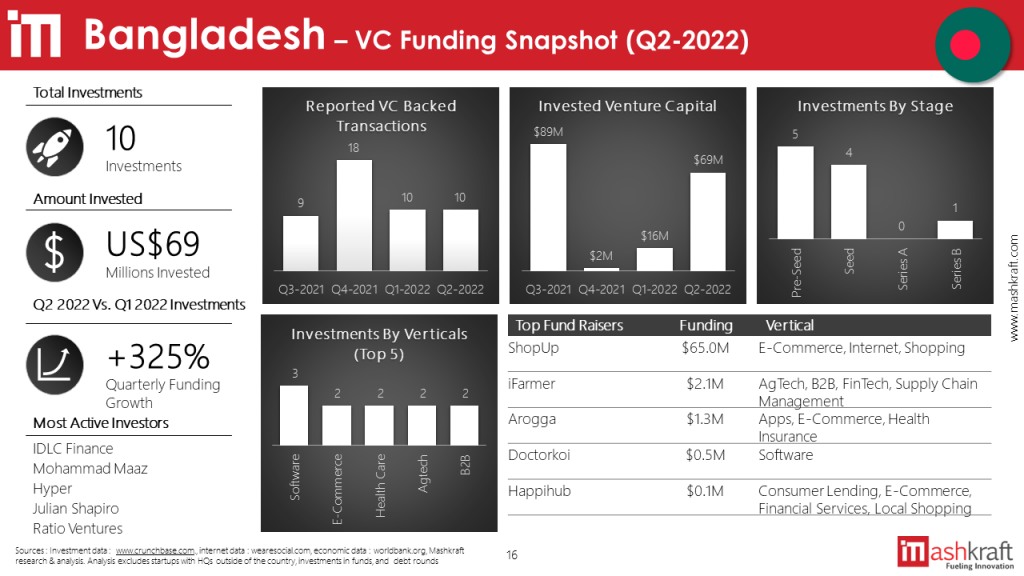

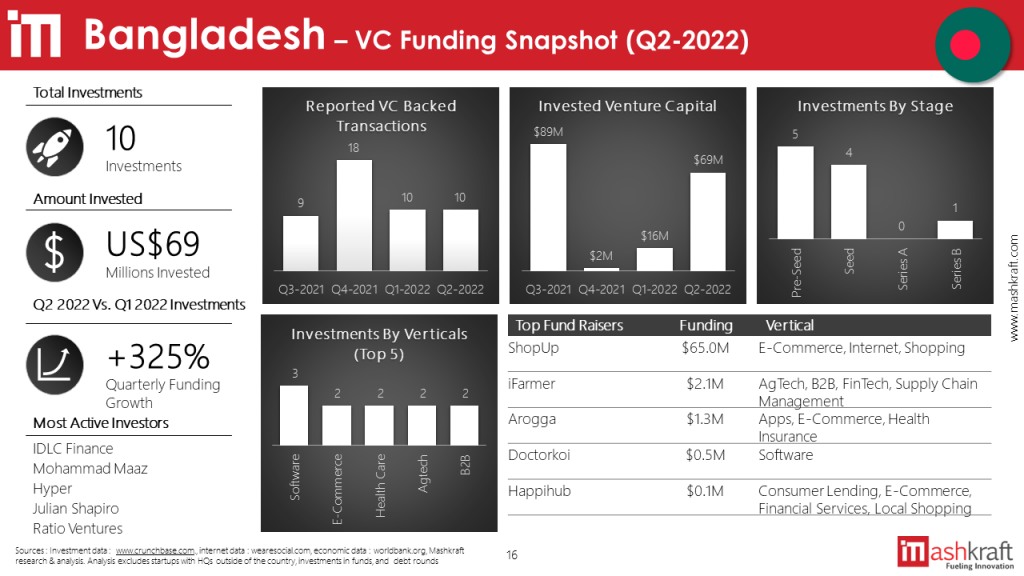

Bangladesh

Bangladeshi startups saw at least 10 VC funding rounds in Q2-2022 with US$69M in invested capital, a 4x quarterly increase. Most of the investments went into e-commerce and fintech companies. Shopup, a Dhaka-based end-to-end travel solutions platform raised the most with $65 M in a Series B round from US-based Valar Ventures.

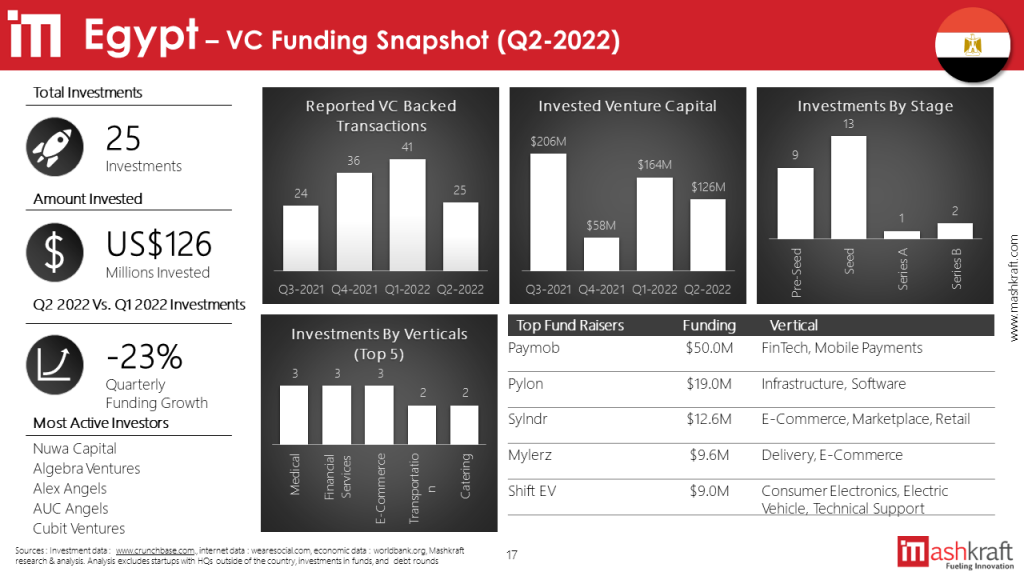

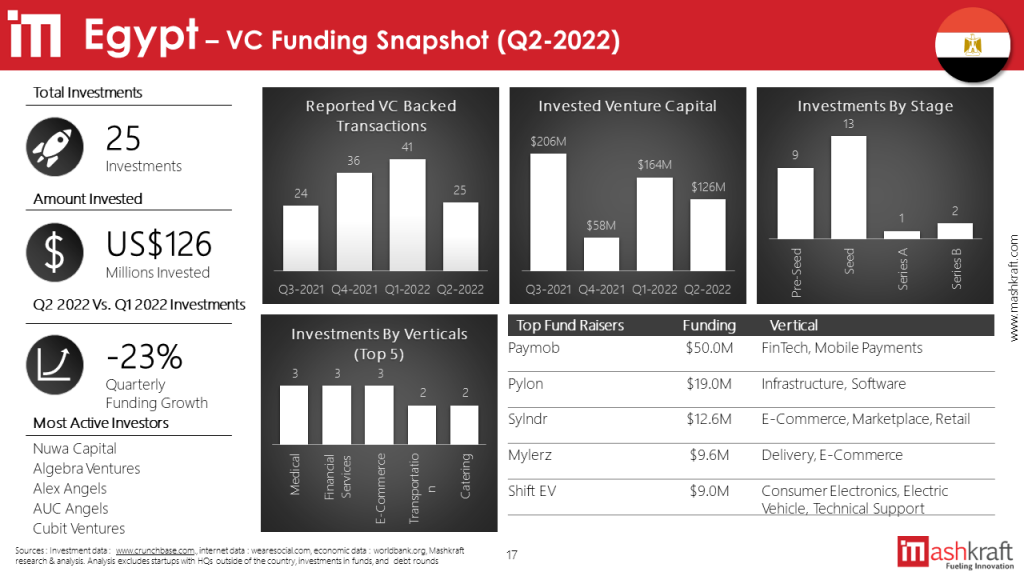

Egypt

Egyptian startups saw at least 25 VC funding rounds in Q2-2022 with US$126M in invested capital, a 23% quarterly decline. Most of the investments went into FinTech and e-commerce companies. Paymob, a Cairo-based digital payments enabler for emerging markets raised the most with US$50 M in a Series B round led by US-based Paypal Ventures.

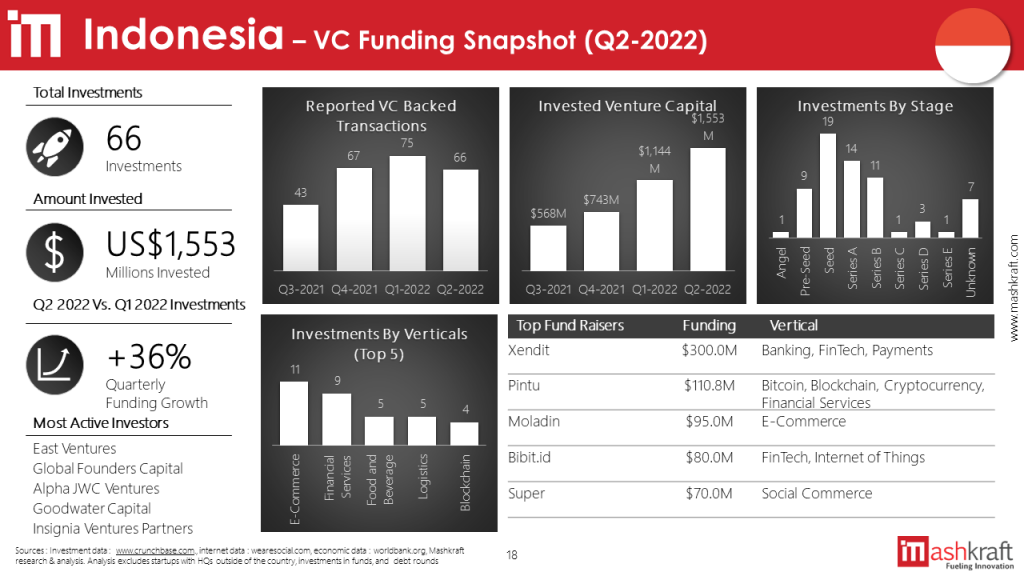

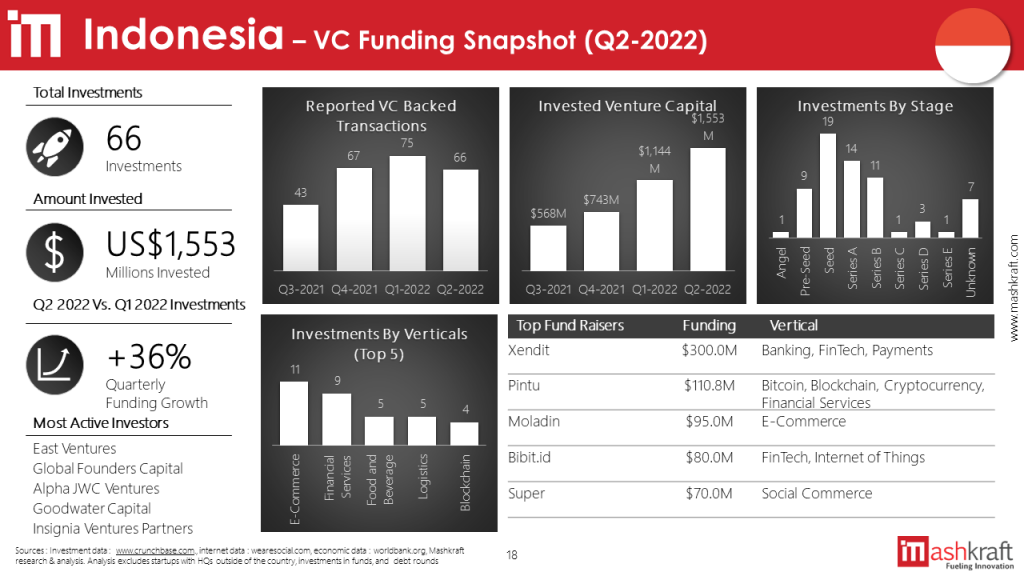

Indonesia

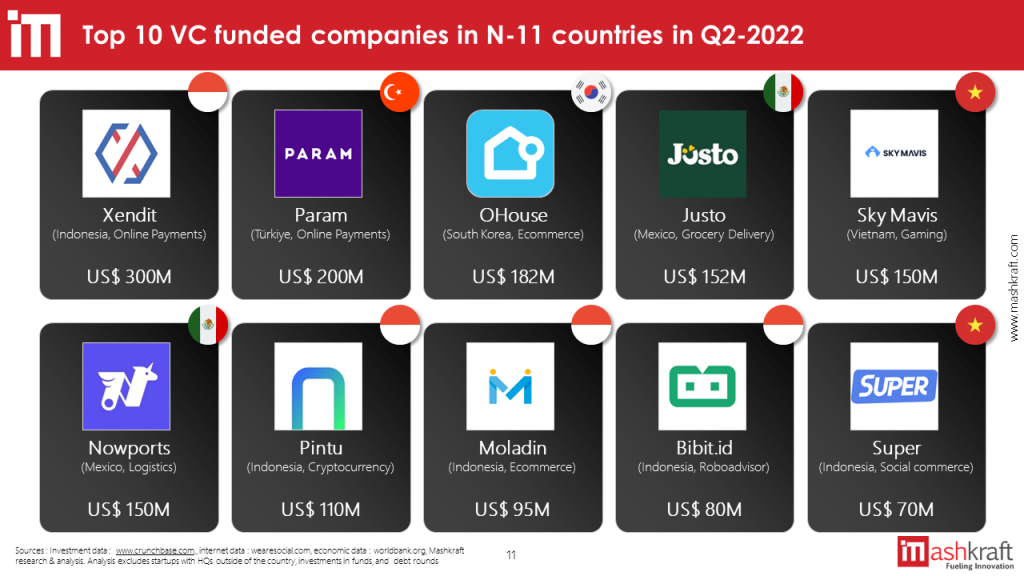

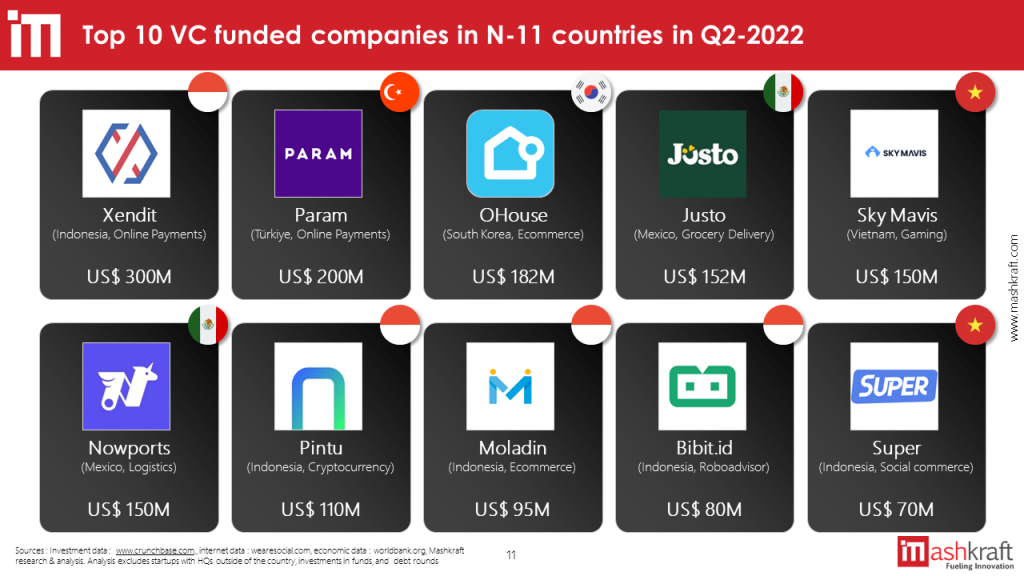

Indonesian startups saw at least 66 VC funding rounds in Q2-2022 with US$1.5 B in invested capital, a 36% quarterly increase. Most of the investments went into FinTech and e-commerce companies. Xendit, a Jakarta-based end-to-end payments enabler for small businesses raised the most with US$200 M in a Series D round led by the US-based Insight Partners.

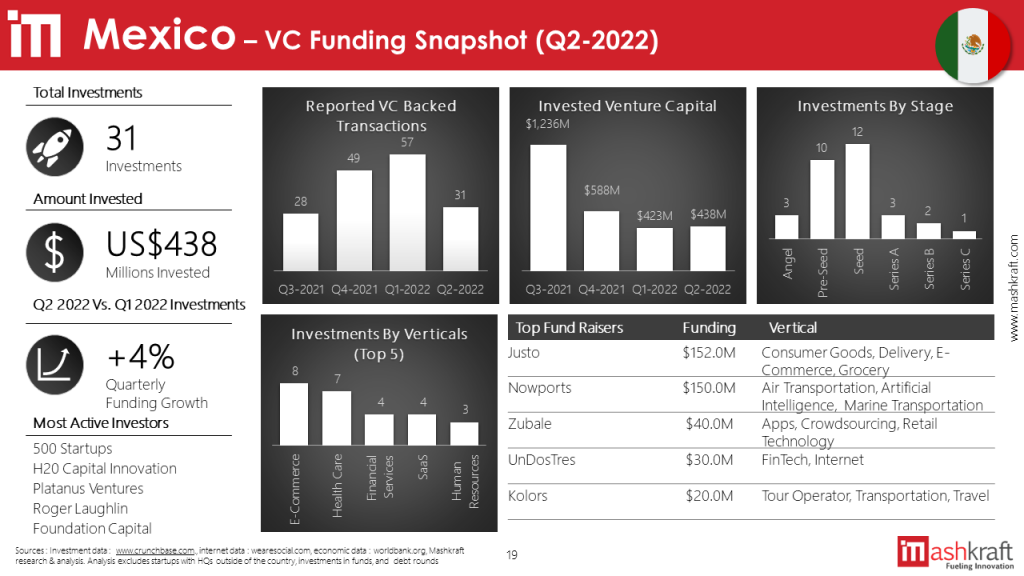

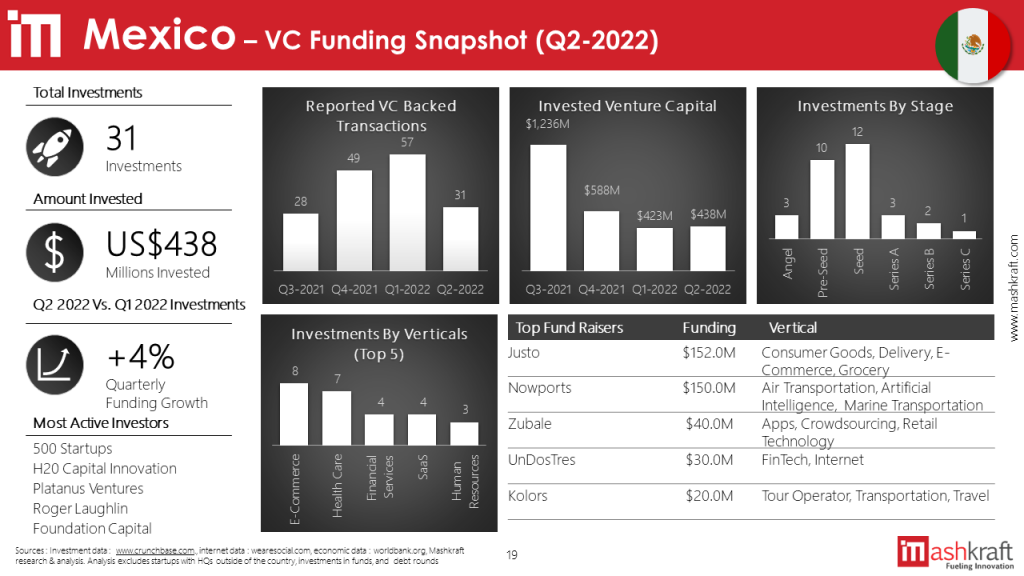

Mexico

Mexican startups saw at least 31 VC funding rounds in Q2-2022 with US$438M in invested capital, a 4% quarterly increase. Most of the investments went into transportation, fintech and e-commerce companies. Jüsto, a Mexico City-based grocery delivery platform, raised the most with US$152 M in a Series B round led by US-based General Atlantic.

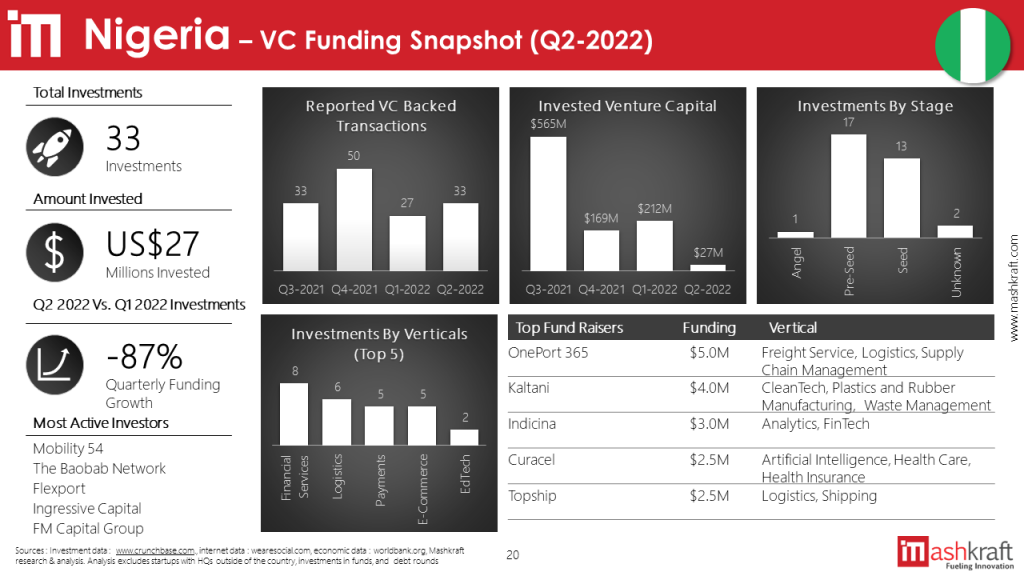

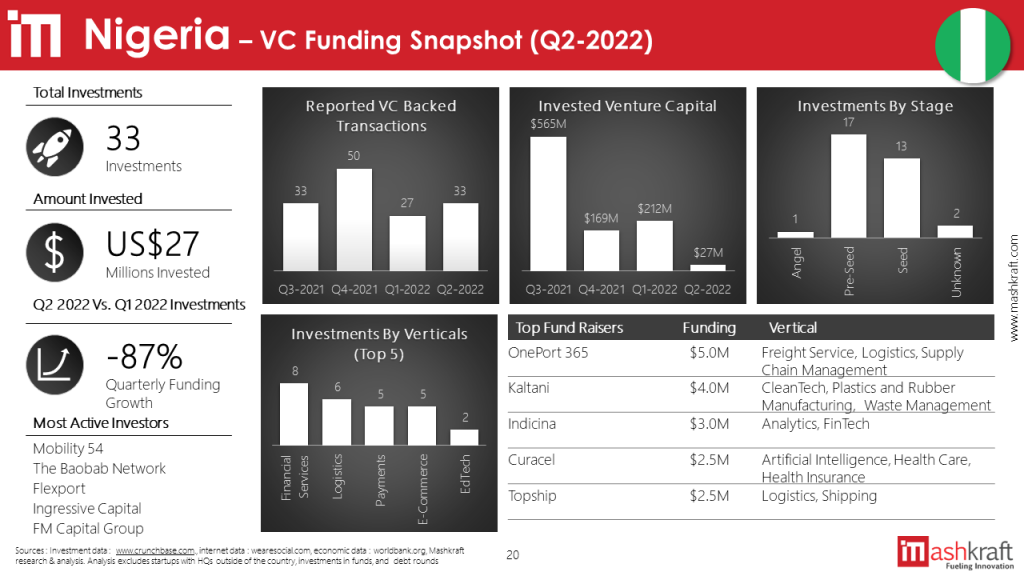

Nigeria

Nigerian startups saw at least 33 VC funding rounds in Q2-2022 with US$27M in invested capital, an 87% quarterly decline. Most of the investments went into fintech, logistics and healthcare companies. OnePort 365, a Lagos-based digital freight forwarding platform, raised the most with US$5 M in a seed round led by Japan-based Mobility 54.

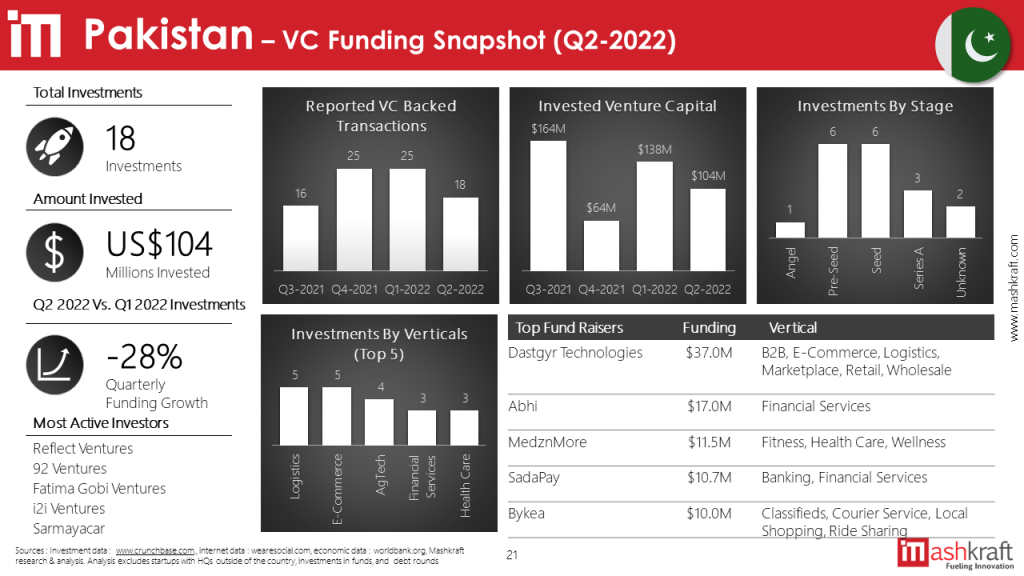

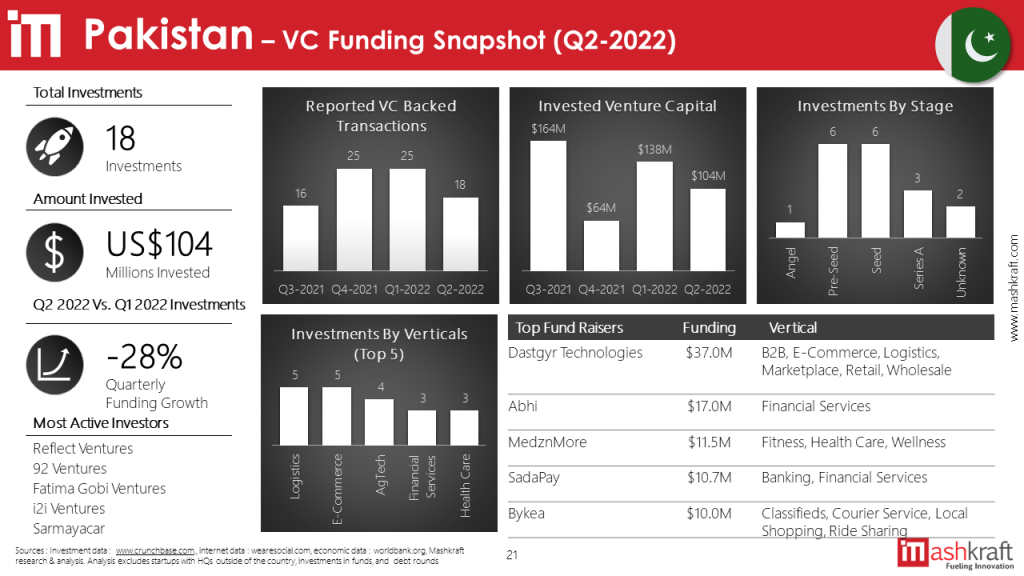

Pakistan

Pakistani startups saw at least 18 VC funding rounds in Q2-2022 with US$104 M in invested capital, a 28% quarterly decrease. Most of the investments went into e-commerce and fintech companies. Dastgyr, a Karachi-based B2B e-commerce platform that connects retailers with wholesalers and manufacturers, raised the most with US$37 M in a Series A round led by Holland-based VEON ventures.

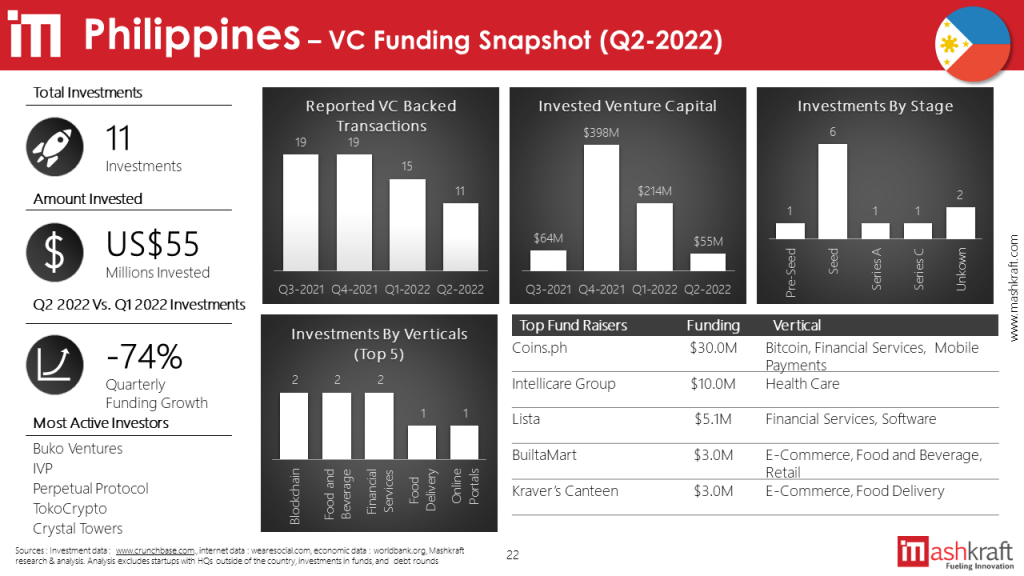

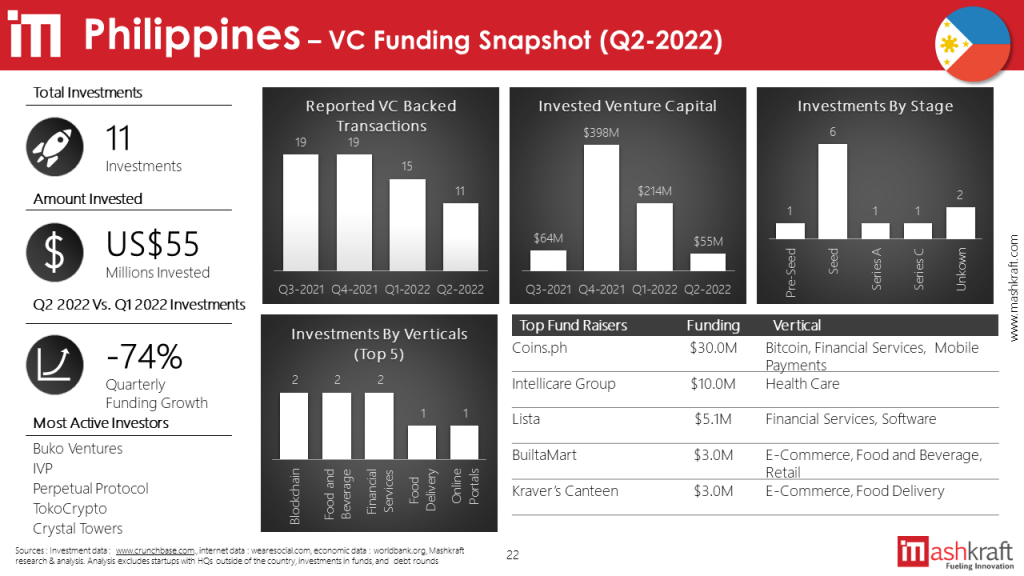

Philippines

Filipino startups saw at least 11 VC funding rounds in Q2-2022 with US$55 M in invested capital, a 74% quarterly decline. Most of the investments went into e-commerce and fintech companies. Pasig Based Coins.ph, which provides financial services to the unbanked, raised the most with US$30 M in a Series C round led by US-based Ribbit Capital.

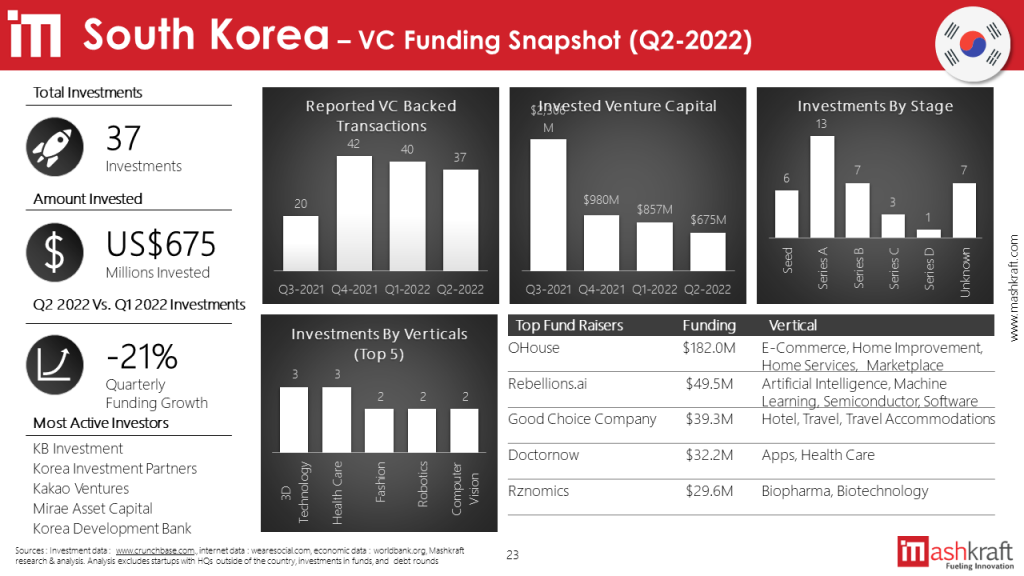

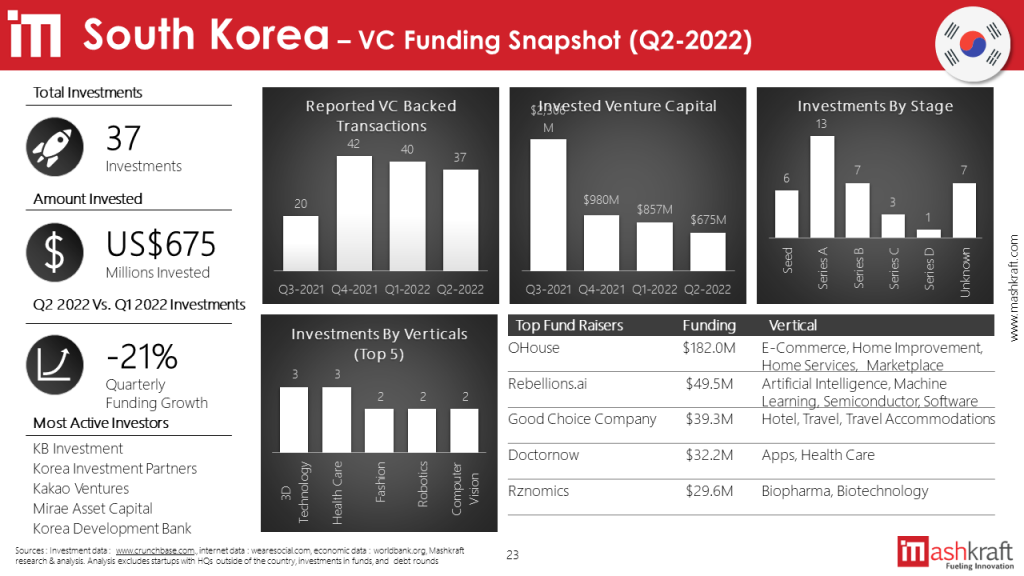

South Korea

South Korean startups saw at least 37 VC funding rounds in Q2-2022 with US$675M in invested capital, a 21% quarterly decline. Most of the investments went into e-commerce and travel, healthcare platforms. OHouse, a Seoul-based ecommerce platform for housing goods raised the most with US$182 M in a Series D round led by Singapore-based Tamasek.

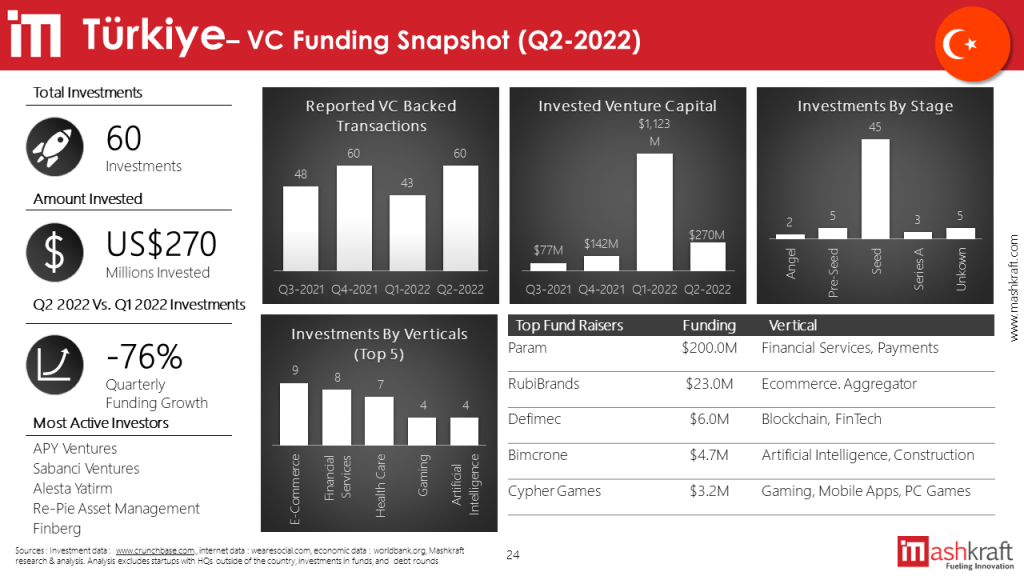

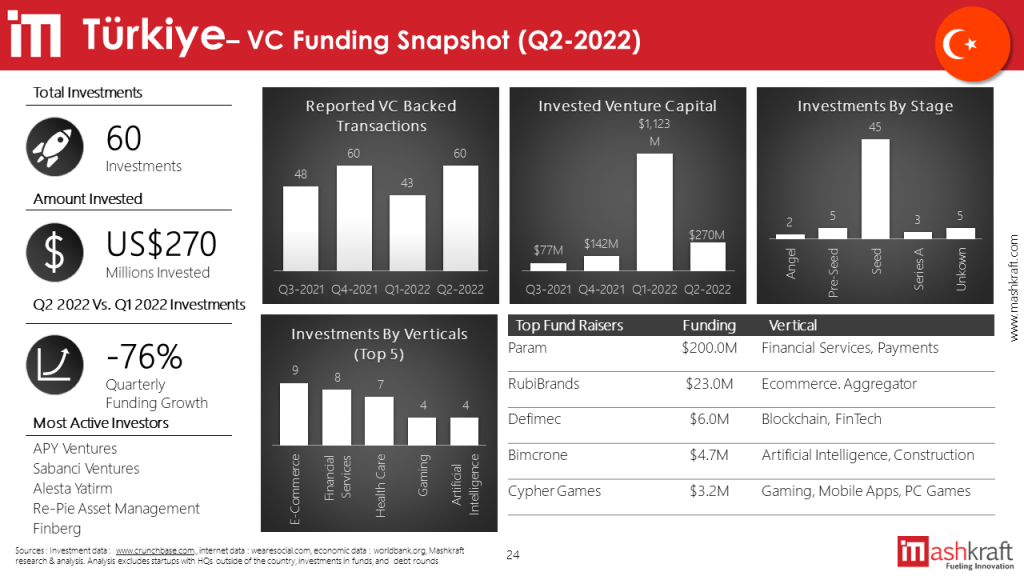

Turkey

Turkish startups saw at least 60 VC funding rounds in Q2-2022 with US$270 M in invested capital, a 76% quarterly decline. Most of the investments went into gaming, e-commerce and fintech companies. Param, an Istanbul-based payments and credit services platform raised the most with US$200 M in a round.

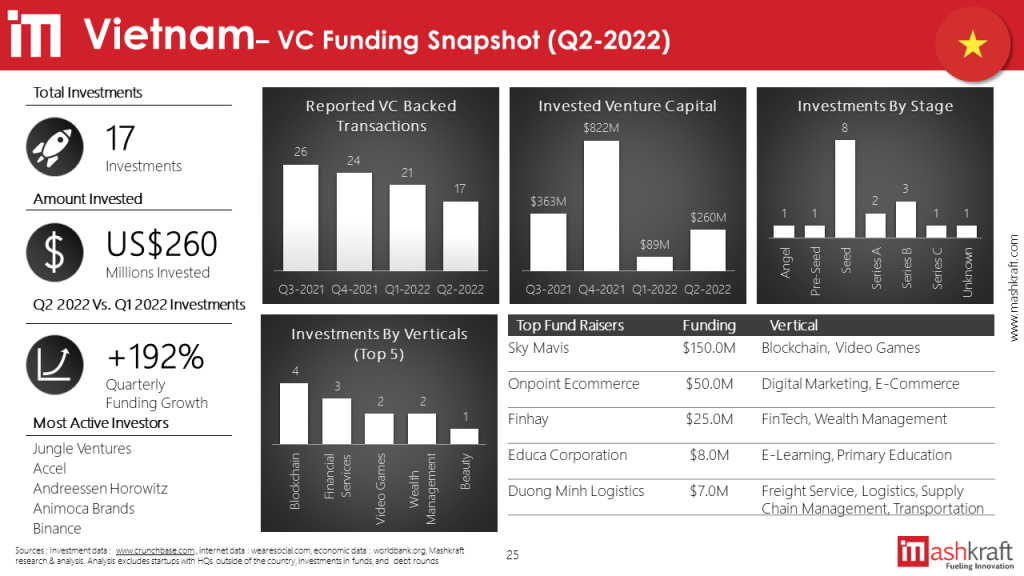

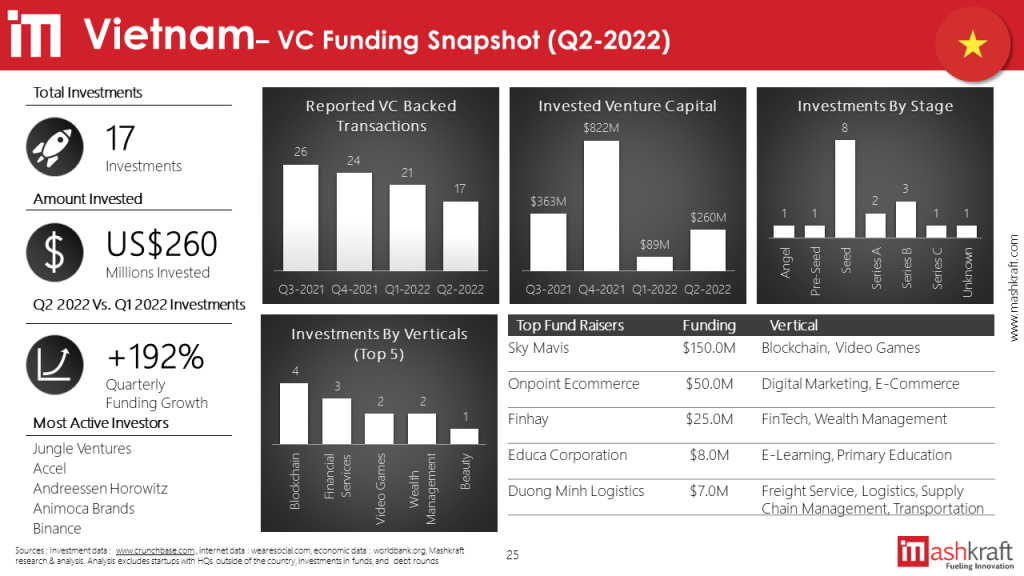

Vietnam

Vietnamese startups saw at least 17 VC funding rounds in Q2-2022 with US$260M in invested capital, a 3x quarterly increase. Most of the investments went into ecommerce, logistics and gaming companies. Ho Chi Minh City-based Sky Mavis, a blockchain-based games and apps creator, raised US$150M in a Series C round led by US-based Binance.